Our financial product suite

Our integrated financial product suite that connects banks and wallets, centralizes treasury operations, and delivers actionable financial intelligence across global entities.

Treasury Plus 6.0

An enterprise treasury management system for cash execution, planning, control, and financial intelligence.

Payments for suppliers, payroll, and inter-company transfers

Cash forecasting, planning, and treasury control

Group-level visibility, reporting, and governance

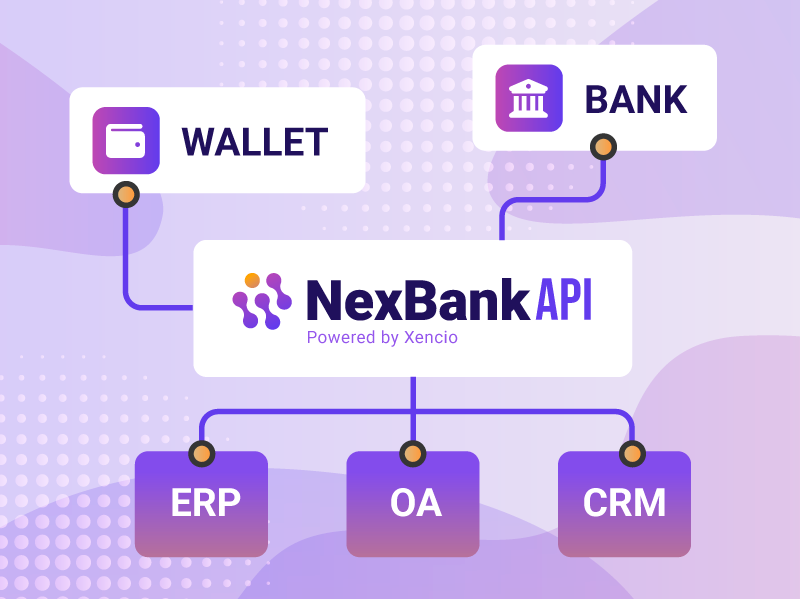

NexBank API

An Open Banking aggregation layer that connects enterprise systems directly to banks via standardized APIs.

Bank account, balance, and transaction data aggregation

API-first integration for ERP, OA, finance, and SaaS platforms

Built for developers, ISVs, and financial institutions

Onewallex

A unified wallet and PSP aggregation solution for managing funds across global payment platforms.

Consolidated balances and transactions across wallets and PSPs

Optimized for cross-border, e-commerce, and platform businesses

Designed for finance teams managing high-volume payment flows

ABOUT XENCIO

Treasury Technology for a

Connected Financial World

Xencio builds treasury-grade financial technology that helps enterprises manage banks, wallets, payments, and financial data with clarity and control.

Our products serve different use cases and audiences, all powered by a shared treasury technology stack designed for scale, reliability, and global operations.

Treasury-grade foundation

Built on a robust technology stack for bank connectivity, wallet aggregation, payments, and financial data integrity.

Purpose-built products

A growing portfolio of specialized solutions designed for distinct ICPs, deployment models, and business needs.

Global connectivity

Support for multi-bank, multi-wallet, and cross-border financial operations across entities and markets.

Enterprise-ready by design

Designed with security, governance, auditability, and scalability at the core.

HOW IT WORKS

Built on Treasury-Grade

Principles

Xencio products are built on a shared set of principles that ensure reliability, scalability, and control across banks, wallets, and financial systems. Rather than isolated tools, each product leverages a common treasury-grade technology foundation designed for global connectivity, execution, and enterprise governance.

This foundation emphasizes consistent, high-integrity financial data—standardized, validated, and traceable across sources—to support accurate payments, treasury operations, planning, and reporting. As a result, Xencio products can address different use cases and deployment models while maintaining a trusted, unified data layer.

01

Connect Once, Scale Globally

Standardized bank and wallet connectivity, built for global operations.

03

Control and Execution at the Core

Payments and treasury execution embedded into enterprise workflows.

02

Purpose-Built, Not One-Size-Fits-All

Independent products for distinct ICPs, powered by a shared treasury foundation.

04

Enterprise-Ready from Day One

Security, governance, and resilience built in by design.

Countries and Regions

1 Billion

Payment Volume

$50 Trillion

Transaction Counterparties

10 Million

TESTIMONIALS

Client stories

Hear from our clients on how Xencio supports their treasury and financial operations across banks, wallets, and systems.

Merck

Boutique Couture increased online sales by 180% in 3 months.

SaaS platform

FlowControl doubled leads monthly and achieved 7× ROAS.

Craft business

Haus & Co. generated 50 qualified inquiries per month at €15 CPL.

B2B industry

TechLine increased download leads by 120% and achieved 4.5x ROAS.

Build your treasury infrastructure

with Xencio

Deployment Methods

Treasury Plus 6.0 by Xencio

Cloud (SaaS)

A fully managed cloud solution for fast deployment and global scalability.

Rapid onboarding with minimal infrastructure effort

Automatic updates, security maintenance, and scaling

Well suited for distributed teams and multi-region operations

Annual subscription

On Premise

A self-hosted deployment for organizations with strict data or compliance needs.